News

Container shipping congestion drops significantly, gloomy outlook for Germany's foreign trade

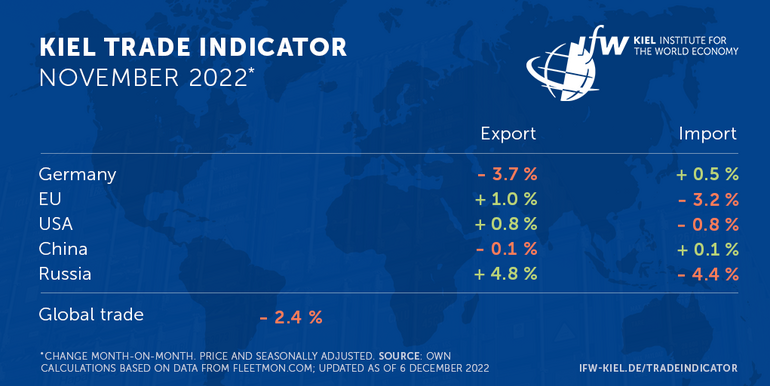

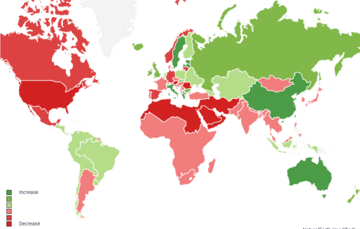

The latest data update of the Kiel Trade Indicator for the month of November shows a significant decline of 2.4 percent in global trade compared with the previous month (adjusted for price and seasonal effects).

Germany's foreign trade is consolidating the negative trend of recent months, mainly due to a decline in exports (-3.7 percent), while imports (+0.5 percent) are in the black.

The EU's November trade shows a weak picture, with a slight increase in exports (+1.0 percent) and a decrease in imports (-3.2 percent).

For the USA, the Kiel Trade Indicator values signal little movement compared with the previous month, with slightly more goods likely to be handled by exports (+0.8 percent) and slightly less by imports (-0.8 percent). Hardly any change is expected for China's trade, with exports (-0.1 percent) and imports (+0.1 percent) likely to be virtually stagnant.

Russia's trade remains volatile. Starting from low levels, the indicator values show a plus in exports (+4.8 percent) and a minus in imports (-4.4 percent).

Gloomy prospects for Germany's foreign trade

"The overall outlook for Germany's foreign trade is gloomy, although material bottlenecks are easing and German industry continues to benefit from a high order backlog," says Vincent Stamer, Head of Kiel Trade Indicator.

"This shows Germany's difficult situation in a cooling world market. Rising energy prices also appear to be weighing on Germany's international competitiveness. The decline in global trade overall is also likely to be a countermovement to the stronger previous month of October. Ubiquitous recession fears are not leaving global trade unscathed. "

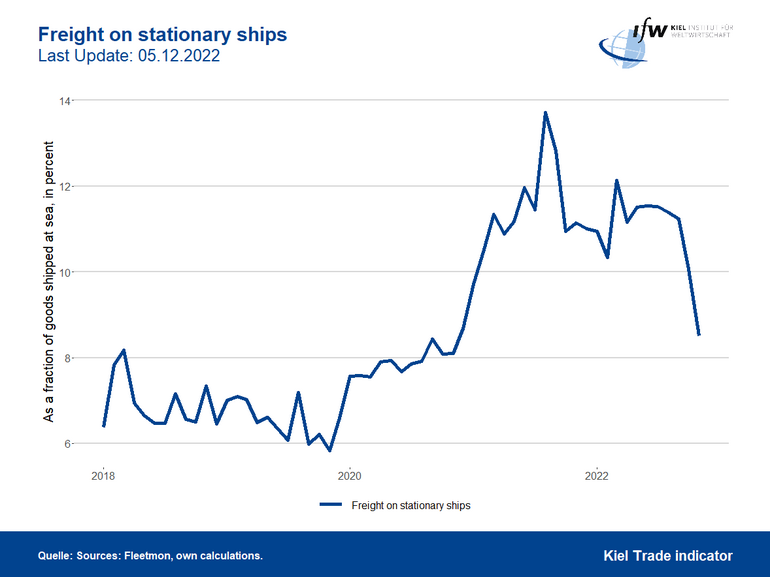

Congestion in container shipping declines

Global congestion in container shipping is declining significantly as a result of subdued November trade. Currently, around 8 percent of all goods shipped worldwide are still in congestion, peaking at almost 14 percent at the end of 2021. For the second month in a row, the share of containers in congestion has fallen rapidly. One reason for this is also the slowdown in maritime traffic in the North Sea, reflecting the weak trade of Germany and the EU.

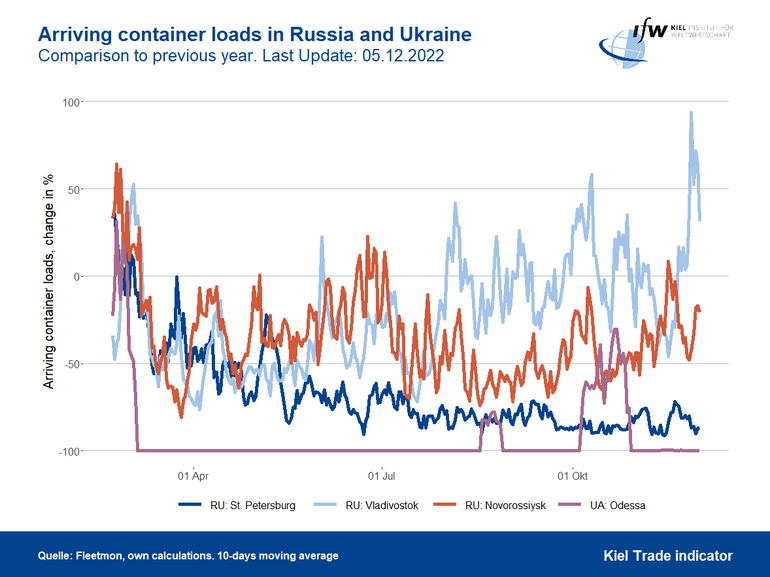

Russia has managed to expand its trade with Turkey and China. The Black Sea port of Novorossiysk and, above all, the Pacific port of Vladivostok, which is located close to China, show a significant increase in incoming container cargoes in November. In contrast, the port of St. Petersburg, which is crucial for trade with Europe, has hardly any container ships docking.

More cargo from China and Turkey to Russia

"The sanctions imposed by the EU and other Western partners are clearly having an effect and cannot be offset by trade with China or Turkey either. Russia's trade as a whole is around a quarter below the level before the war of aggression against Ukraine, and no trade data has been reported by the official statistic offices since the summer," Stamer said.

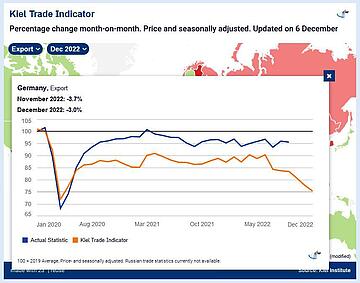

Algorithm of the Kiel Trade Indicator improved

With today's update, the Kiel Institute has further improved the algorithm of the Kiel Trade Indicator, reducing the forecast error by around a quarter and increasing the estimation accuracy accordingly. In addition, the Kiel Trade Indicator website will in the future show also the actual development for each of the 75 countries for which the Kiel Institute calculates trade data in real time, in addition to the estimated values (see screenshot).

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on December 22 (without media information) and January 6, 2023 (with media information for December 2022 trade data).

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into real, seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.