News

World trade clouds over

The latest Kiel Trade Indicator data update shows a significant drop of 1.6 percent in global trade inJuly compared with the previous month of June (adjusted for price and seasonal effects).

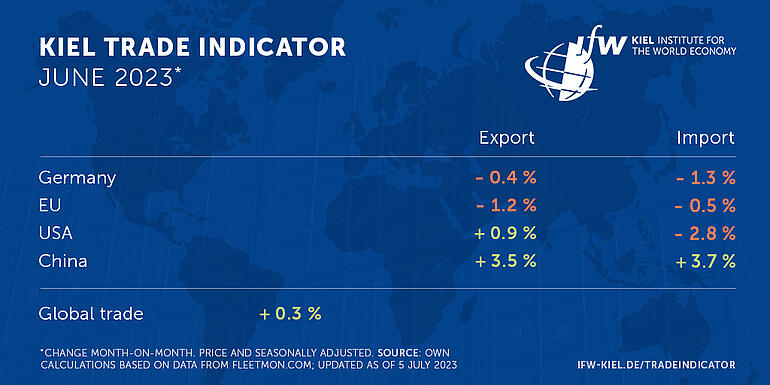

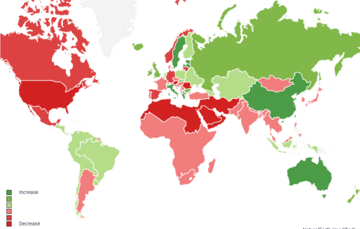

For Germany, theKiel Trade Indicator values for both exports (-0.4 percent) and imports (-1.2 percent) are in the red. The same applies to an even greater extent to EU exports(-1.6 percent) and imports (-1.5 percent).

"The economic downturn has a firm grip on Europe. In the last ten years, business sentiment has only been worse in the pandemic year 2020 for the economically strongest countries, Germany and France. The trade figures reflect this now," says Vincent Stamer, Head of Kiel Trade Indicator.

"The restrictions in the Panama Canal due to the low water are almost inconsequential for Europe, the importance of the trade route is too low. No restrictions at all were observed for maritime traffic as a result of the accident in the North Sea."

Importance of China as an export market declines

Among the highlighted countries, the sharpest decline is recorded for U.S. exports (-3.7 percent), and imports (-0.8) are also negative.

"In contrast to Europe, North America is showing signs of bottoming out in corporate sentiment, so despite equally poor trade figures in July, the outlook for the U.S. is fundamentally better," Stamer said.

China's trade is seeing a setback after the upward trend of recent months, with exports (-1.6 percent) and imports (-0.7 percent) in the red. "China is importing noticeably fewer goods from the world in inflation-adjusted terms than it did during the boom phase in 2021," Stamer says.

China's share of German exports fell in the first half of the year from 7.0 percent last year to 6.2 percent this year. The USA is the most important single customer country for German exports, with a share of almost 10 percent.

Declining activity on the world's oceans

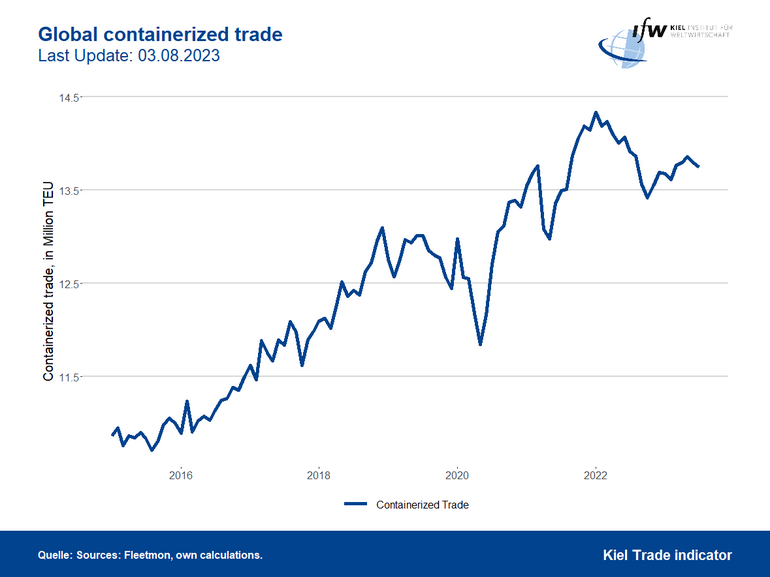

The slightly declining activity on the world's oceans fits into the picture of the weak trade figures in July. The volume of standard containers shipped fell to around 13.7 million, 1 percent below its interim high in May and now 4 percent below its all-time high in spring 2022.

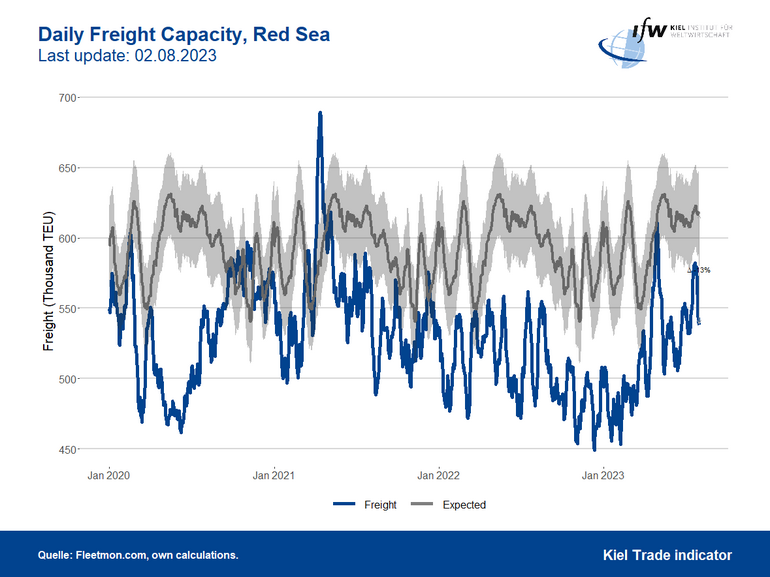

Congestion of container ships is declining slightly, and the volume of goods shipped in the Red Sea, the most important maritime trade route between Europe and Asia, is down by around 50,000 standard containers, which is around 13 percent below the figure that would be expected.

The next update of the Kiel Trade Indicator will be on August 8 (without media information) and on September 7 (with media information) for August trade data.

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into price and seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.