News

World trade picks up, Russia's port activity almost at pre-war level

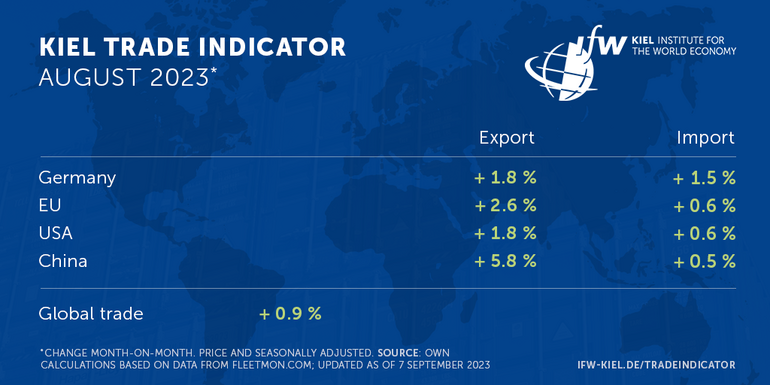

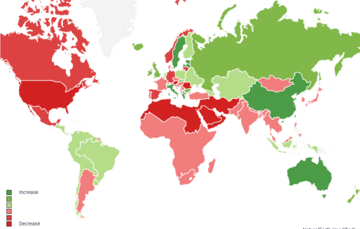

The latest Kiel Trade Indicator data update shows a 0.9 percent increase in global trade in August compared with the previous month of July (adjusted for price and seasonal effects).

For Germany, the August figures for both exports (+1.8 percent) and imports (+1.5 percent) are quite clearly in the black. "The figures point to a recovery in German trade, after the Federal Statistical Office had recently reported a decline for July exports, but unlike the Kiel Trade Indicator, the values are not adjusted for inflation. It remains to be seen whether German exports will really turn around, as the weak global economy means that demand for new German machinery and other capital goods tends to decline," says Vincent Stamer, Head of Kiel Trade Indicator.

The signs for EU trade arealso positive, with exports (+2.6 percent) noticeably up and imports (+0.6 percent) slightly up. For the US, the Kiel Trade Indicator points upwards for exports (+1.8 percent) and imports (+0.6 percent). China isalso expected to trade more goods in August than in July, with exports (+5.8 percent) likely to make a much bigger jump than imports (+0.5 percent), which are only slightly above the previous month's level.

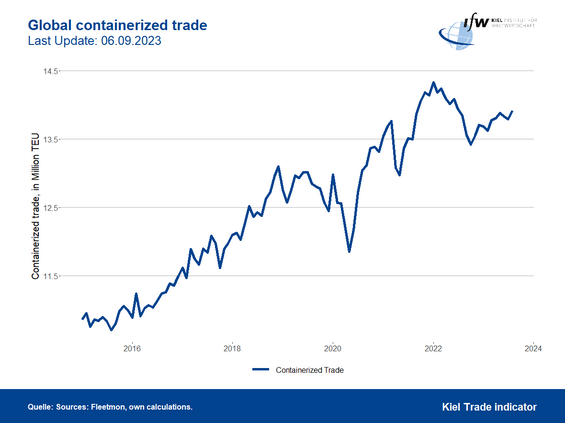

The overall positive August figures for global trade are also supported by figures on shipped and congested goods. The volume of standard containers shipped rises slightly in August to almost 14 million, with the proportion of these incongestion falling to around 7.5 percent, which is not unusual by historical standards.

Yet the congestion off the Panama Canal has virtually no impact on the global transport of goods, with only 0.5 percent of global cargo capacity stuck there. "Only a fraction of the global container fleet is affected by the low water in the Panama Canal. Due to the size restriction, ships with the biggest dimensions do not pass the canal anyway. And also, waiting container ships are given priority by the canal authority during processing, so that mainly chemical, LNG, or oil tankers are stuck," says Stamer.

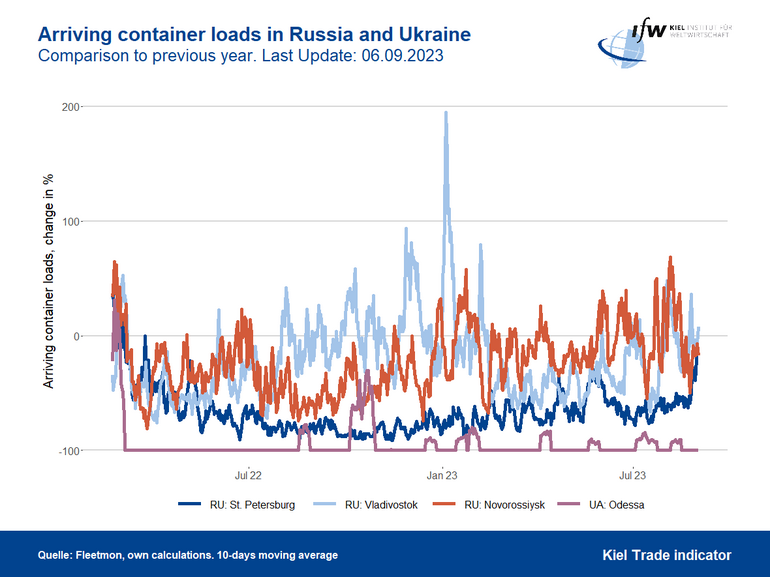

Activity in Russia's ports approaches pre-war level

Activity in Russia's ports is surprisingly high. For the first time since the outbreak of the Ukraine war, the volume of goods unloaded at Russia's three largest container ports, St. Petersburg, Vladivostok, and Novorossiysk, is approaching the levels seen at the outbreak of the war.

In particular, arrivals at Russia's most important container port, St. Petersburg, had slumped by 90 percent in the meantime and then jumped in recent weeks. "Where the goods are coming from is not clear from the container ship movements, but Russia seems to be rejoining the world trade. This occurs despite sanctions imposed by Western nations and the falling value of the ruble, which is disappointing," Stamer says.

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on October 5 (with media information) for September trade data.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into price and seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.