News

Global trade declines, Middle East conflict without acute impact on trade

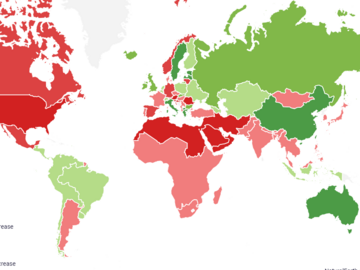

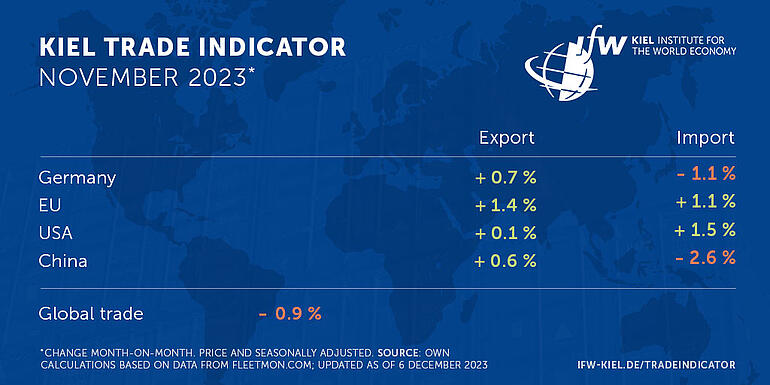

The latest data update of the Kiel Trade Indicator points to a rather mixed trading month in November for global trade and trade between major economies.

According to the data, global trade fell by 0.9 percent compared to the previous month of October (price and seasonally adjusted). For the EU, the trade figures are slightly positive for both exports (+1.4 percent) and imports (+1.1 percent). Germany's foreign trade continues its ongoing weak phase. Exports (+0.7 percent) were up slightly, while imports (-1.1 percent) were down.

"Since the outbreak of the COVID-19 pandemic, German foreign trade has basically only been growing because prices are rising. Adjusted for inflation, exports and imports have been more or less flatlining for years," says Vincent Stamer, Head of Kiel Trade Indicator.

"According to Kiel Trade Indicator data, there is no improvement in sight in the short term. German foreign trade is unlikely to see any Christmas cheer due to the weak economy and high interest rates."

In the US, exports (+0.1 percent) are likely to remain at the previous month's level, while imports (+1.5 percent) are expected to rise slightly. For China, the Kiel Trade Indicator values show a slight plus or a green zero for exports (+0.6 percent) and a minus for imports (-2.6 percent).

Container volumes are falling, especially in the Red Sea. A consequence of the Middle East conflict?

The less positive outlook for November trade is also reflected in the volume of standard containers shipped worldwide. It fell by more than 1 percent in November compared to October and is therefore back below the 14 million mark.

The number of standard containers shipped in the Red Sea in particular has fallen. In November, a good 500,000 standard containers were transported there, based on experience from 2017 to 2019, just under 600,000 units would have been expected.

"There is always a gap between the actual and expected container volume in the Red Sea because China has become more independent of the trade with the Western countries and Germany. The recent decline in cargo volumes is mostly due to a negative business cycle effect, not yet a result of the recent targeted attacks on merchant ships in the Red Sea," says Stamer.

"Terrorist attacks on merchant ships in the Red Sea could, however, become a new burden on world trade in the future, especially if freight rates rise due to hazard surcharges. In the long term, shipowners could also switch to alternative routes or means of transportation. Over 10 percent of global trade passes through the Red Sea and the Suez Canal, and disruptions there will have a significant impact on the global movement of goods."

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on January 9, 2024 for December 2023 trade data.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into price and seasonally adjusted growth figures compared with the previous month.

We update the data once a month around the 5th and then present the latest calculations for trade in the current and the previous month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.