News

Weak US trade weighs on global trade

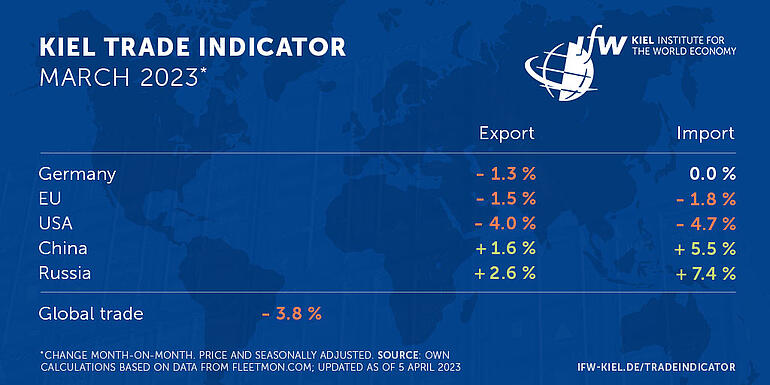

After a strong start to the year, global trade is losing momentum and, according to the latest update of the Kiel Trade Indicator, is likely to have contracted significantly by 3.8 percent (price and seasonally adjusted).

For the US in particular, the indicator signals a significant decline in imports (-4.7 percent) and exports (-4.0 percent) in March compared to February. The development in North America was also responsible for the weakening of global trade.

"Now that the US. population has spent the wealth saved during the pandemic, people seem to be saving more due to inflation and therefore spend less on consumer goods from overseas. The largest US container ports in their respective coastal regions (Los Angeles/Long Beach, Houston, and New York/New Jersey) have experienced monthly declines of about 10 percent," says Vincent Stamer, head of Kiel Trade Indicator.

China halted the downward trend of previous months in March. There were signs of a significant increase in imports (+5.5 percent) and a positive trend in exports (+1.6 percent).

Foreign trade also appears to be growing for Russia, with imports up 7.4 percent month-on-month and exports up 2.6 percent.

The values of the indicator for Europe as a whole and for Germany are slightly negative.

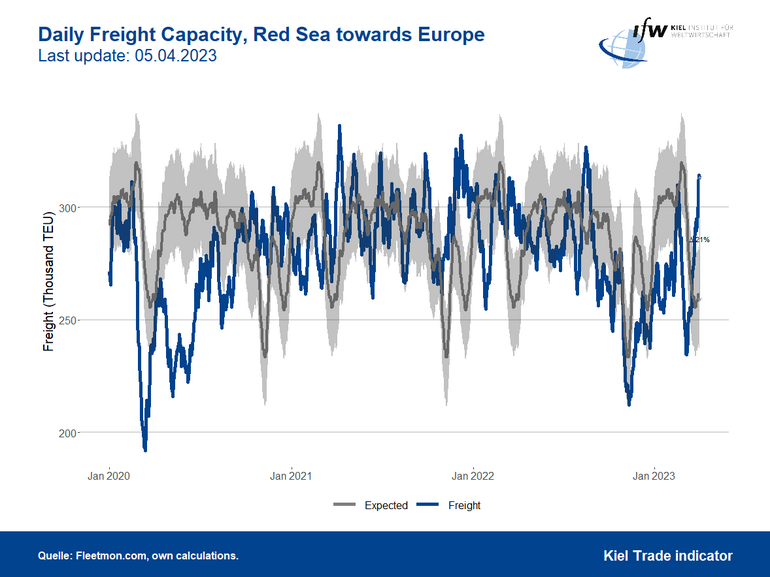

For about a year, cargo volumes in the Red Sea were at times well below expected levels. In March, however, they returned to expected volumes. After weak winter months, this could now signal a turnaround in trade between Europe and China. In the Red Sea, looking only at the direction of travel from Asia to Europe, the analysis shows that Asian exports to Europe, while not exceeding expectations, have mostly met them. The main reason for the decline in cargo volumes in the Red Sea last year was therefore the flow of goods from Europe (and to a lesser extent from North America) to Asia.

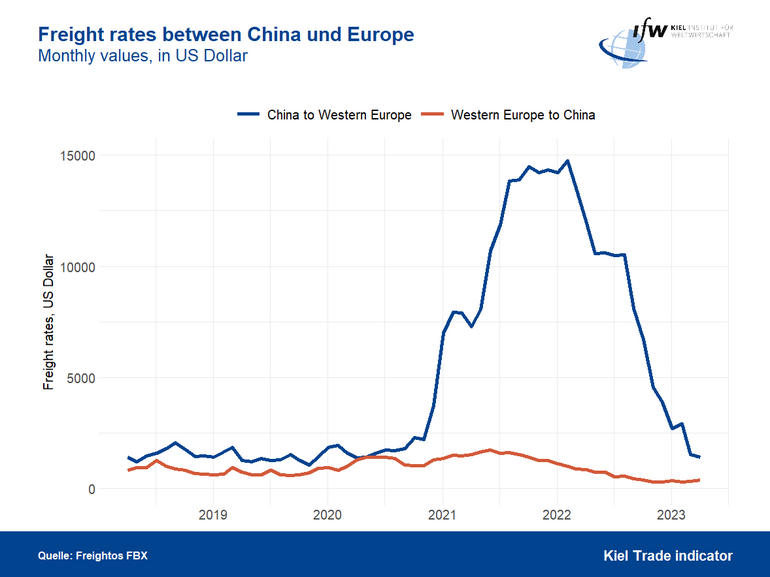

As a result of weaker trade between Asia and Europe and newly delivered container ships, short-term freight rates (spot rates) for container shipments havefallen back to pre-crisis levels. With freight rates of USD 1,400 for the transport of a container from China to Germany, for example, freight rates are at ten percent of their peak from the fall of 2021. This trend could also make European imports from the Far East cheaper in the coming months.

At the same time, it is striking that freight rates from Europe to Asia have tended to fall slightly over the entire period since the pandemic. This is also an indication that goods exports from Europe to Asia have experienced a period of weakness.

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on April 21 (without media information) and on May 5 (with media information) for April trade data.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into price and seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.