News

Kiel Trade Indicator 11/21: Fragile upward trend in global trade

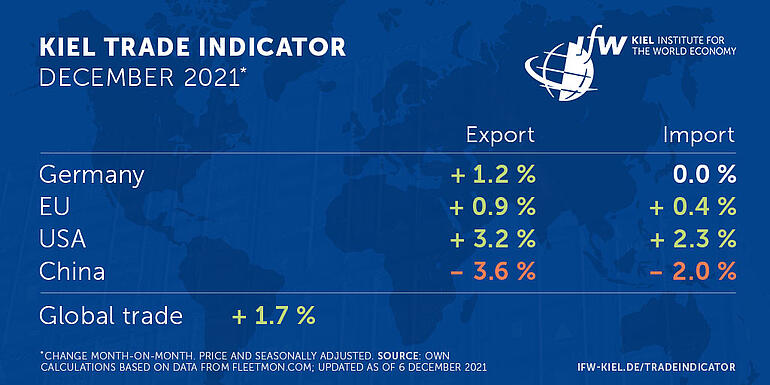

After months of stagnation, US trade could record a positive trade impulse again in November compared to the previous month for the first time since July. Estimates from the Kiel Trade Indicator are up for both exports (+3.2 percent) and imports (+2.3 percent) (price and seasonally adjusted).

Germany'sexports could increase slightly (+1.2 percent), while imports are likely to stagnate (0.0 percent). For the EU slightly positive developments are possible for both exports (+0.9 percent) and imports (+0.4 percent).

Total world trade is expected to be 1.7 percent higher in November than the previous month.

For China's trade, however, the Kiel Trade Indicator signals negative values. It shows a decline of 3.6 percent for exports and 2.0 percent for imports. The gentle upward trend of September and October would thus be broken.

"The positive trade figures for the month of November are encouraging. However, the upward movement is extremely fragile. It is to be feared that the joy will only last for a short time due to the still massive congestion in global container shipping. Congestion has remained at a very high level for around two months, preventing a clear upward trend in global trade," says Vincent Stamer, Head of Kiel Trade Indicator at the Kiel Institute.

Around 8 percent of global freight capacity in container shipping is currently tied up in congestions off the US ports of Los Angeles/Long Beach and Savannah, as well as in the Pearl River Delta and off Ningbo-Zhou in China. More than 11 percent of all shipped goods are stuck in queues.

The volume of cargo in the Red Sea, an important indicator of European-Asian trade, has come somewhat closer to its expected level, but still lags behind it by around 7 percent.

"Christmas shopping this year is clearly under the sign of supply problems, which is expressed in a reduced supply, longer delivery times and higher prices. But German industry is also cooking on the back burner due to a lack of intermediate goods. Improvement is not in sight until after the Chinese New Year in the first half of 2022, but even then, it might take some time before the global supply network is swinging back into sync. Delivery delays and bottlenecks could therefore keep us busy well into next year," says Stamer.

Update for the Kiel Trade Indicator

With the latest data update, the Kiel Institute introduces a number of improvements to the Kiel Trade Indicator. The most important is the conversion of trade estimates from nominal to real data. The price adjustment increases the estimation accuracy of the Kiel Trade Indicator, for instance because price fluctuations due to supply bottlenecks or inflation are no longer reflected in the trade data.

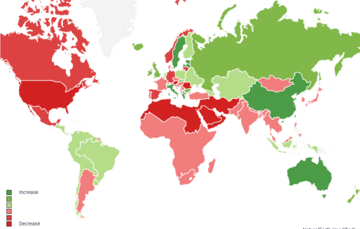

In addition, estimates are made for a larger number of countries and regions. The update provides better coverage of the Global South, such as Sub-Saharan Africa, North Africa, the Middle East, or emerging Asia. We also break down Europe's trade into intra- and extra-EU trade flows.

This is accompanied by a change in reporting for the media. The Kiel Trade Indicator will continue to be updated twice a month on the website. At the 20th for the current and the following month (from now on without media information) and at the 5th with updated data for the past month (from now on with media information) as well as an initial estimate for the month just started.

For more information on the Kiel Trade Indicator and forecasts for 75 countries, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on December 20, 2021 (without press release) and on January 5, 2022 (with press release).

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) for 75 countries worldwide, the EU and world trade as a whole. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into real, seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.