News

IfW economic forecast: Self-sustained recovery

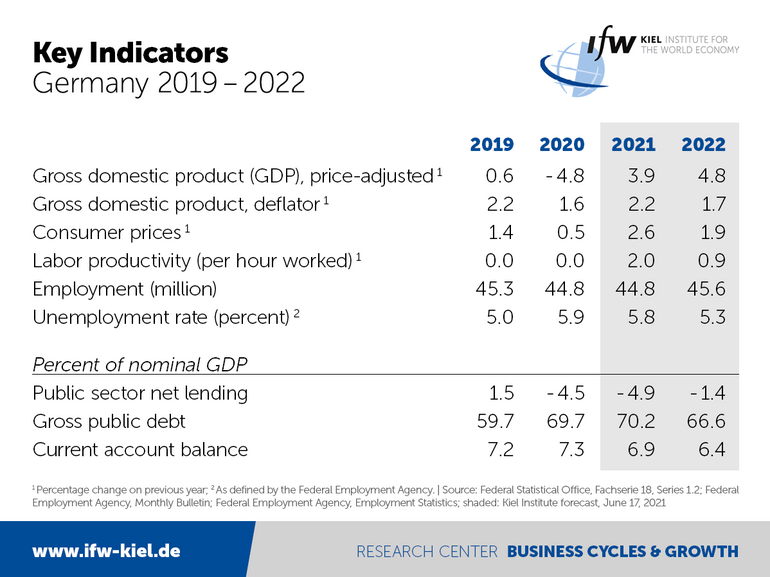

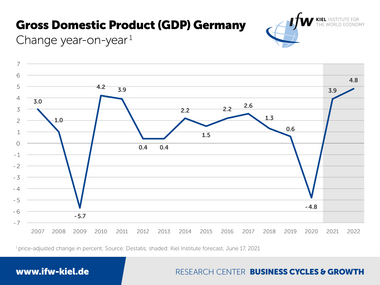

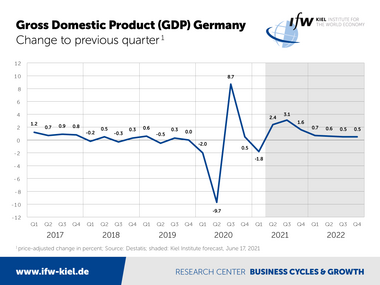

The German economy is recovering strongly and is expected to return to its pre-crisis level in the third quarter. In its latest economic forecast, Kiel Institute expects gross domestic product (GDP) to grow by 3.9 percent in 2021 (previously 3.7) and by 4.8 percent in 2022. "Higher growth rates are prevented by supply-side frictions, feeding into higher prices," says Stefan Kooths, Kiel Institute head of forecasting. In 2021, inflation raises to 2.6 percent, with the public budget deficit growing to more than 175 billion euros. The unemployment rate will fall to 5.3 percent by 2022.

As the pandemic recedes, trade and contact-intensive services (e.g., hotels and restaurants) in particular should benefit from a strengthening of private consumer spending, which is expected to increase by 2.4 percent in 2021 and 8.2 percent in 2022.

By contrast, despite order inflows at record-high levels, the recovery in manufacturing is currently hampered by supply bottlenecks but is expected to continue in the second half of the year and then receive additional impetus from catch-up effects.

"The steam pressure in the German economy is high. Demand, additionally fueled by pent-up purchasing power and government stimulus programs, is meeting supply constraints due to supply-side frictions. All in all, the signs are pointing to strong expansion. However, this is driving up prices where production capacities cannot yet be readjusted to the higher demand," says Kooths on the occasion of the Kiel Institute´s summer economic forecast presented today.

Inflation rates of up to 4 percent during the year

During the year 2021, inflation rates could then reach up to 4 percent. On average, inflation is likely to be 2.6 percent. The German government's climate package is responsible for 0.4 percentage points, and the increase in VAT rates adds another 1.2 percentage points. In 2022, inflation should slow somewhat to then 2 percent.

In total, private households have accumulated 200 billion euros in purchasing power during the pandemic, but only a small portion of this will probably find its way into extra purchases. "If consumers draw more heavily on their financial cushion, this will drive prices up even stronger than expected, and this is currently the greatest threat to price stability," says Kooths.

"We will have to get used to higher inflation rates even after the special effects of the pandemic are over," says Kiel Institute President Gabriel Felbermayr. "Also, because the European Central Bank cannot counteract this by raising interest rates without endangering stability in highly indebted countries like Italy. If inflation really gets out of hand and forces the ECB to act, we're in for the next euro crisis."

The strong recovery of the German economy is also helping the labor market. In 2021, the average number of people in work is expected to stabilize while job creation is already under way. Next year, employment numbers will increase by 740,000. The unemployment rate is expected to fall from 5.8 percent in 2021 to 5.3 percent in 2022.

Public budgets are expected to record a deficit of over 175 billion euros at the end of the year, 5 percent in relation to GDP. Germany's debt level will thus grow to 70 percent. Next year, the deficit should then fall to just over 52 billion euros, 1.4 percent of GDP, and the debt level to 67 percent.

Exports are expected to increase by 11.2 percent in 2021, then by 5.8 percent in 2022. Germany's current account balance is expected to decline to 6.4 percent by 2022, partly due to worsening terms-of-trade.

Business investment is recovering at high pace, rising by 4.3 percent (2021) and 5.2 percent (2022). However, the construction industry in particular is currently limited by material bottlenecks, which are primarily reflected in higher prices. Construction investment is expected to rise by 2 percent in the current year and by 2.5 percent in the coming year, with construction prices rising by a very strong 4 percent in both years.

„Germany’s upswing is self-sustaining. Further stimulus programs would be beside the point as most of the anti-crisis fiscal support to the private sector becomes effective only now when the recovery sets in. During the pandemic, measures for infection protection step on the macroeconomic brake, while parallel fiscal support steps massively on the accelerator. Thus, loosening the brake already kick-starts the domestic economy while the manufacturing sector, after the catch-up sprint last year, is currently struggling with supply-side frictions. To prevent the economy from overheating, monetary and fiscal policy should throttle down rather sooner than later “, says Kooths.

Global post-corona boom and commodities supercycle under way

World trade is also currently characterized by supply bottlenecks and logistical problems, which are reflected not least in sharp price increases for raw materials, intermediate goods and transport services, also fueled by spending programs in the USA and the EU and a continuing expansionary stance of monetary policy. Global output is expected to increase by 6.7 percent in 2021 and by 4.8 in 2022, thus outpacing the medium-term trend.

"For iron and steel in particular, as well as the non-ferrous metals lithium, copper, aluminum and cobalt, a so-called supercycle can currently be assumed, i.e. a long-lasting, very high price level above the long-term average. This will affect the construction industry and the expansion of renewable energies, electromobility and IT infrastructure," says Kooths.

The Federal Reserve in the United States is likely to tighten its monetary policy earlier than before in view of the pressure on prices. This entails the risk that tougher financing conditions will trigger turmoil on the international capital markets in light of high debt levels.