News

Corona: International financial aid will reach new highs

"When international private capital markets freeze, states or public creditors such as the International Monetary Fund (IMF) have very often stepped in. We are seeing this again now with the Corona crisis, where more than 100 countries have already asked the IMF for help. We are facing a new sharp increase in international rescue loans," said Kiel Institute researcher Christoph Trebesch, who heads the International Finance Research Center.

According to the analysis, states borrow very large sums of money from each other, especially in times of crisis, and the sums often exceed the amounts transferred in international private markets. Especially aid in times of war and global financial crises is enormous. "Neither the planned EU aid package of 750 billion euros to tackle the Corona crisis nor the Greek loans are unusual in historical comparison," said Trebesch.

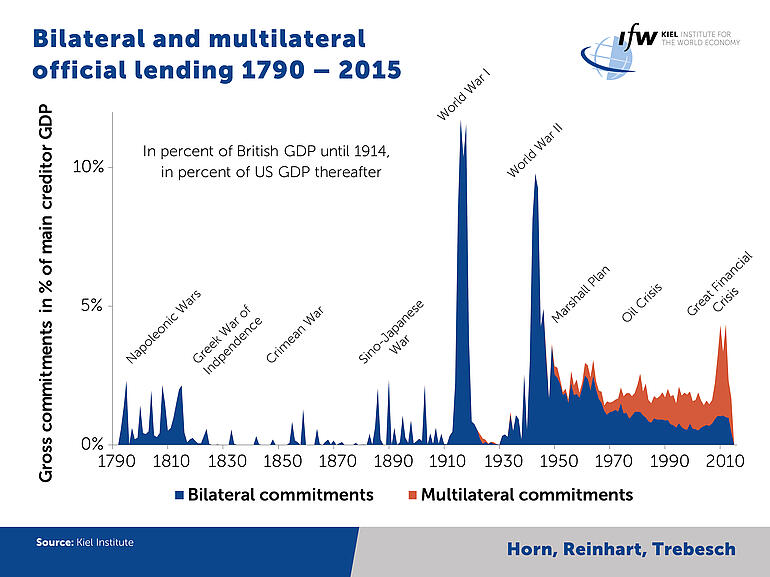

During the First World War, international aid amounted to twelve percent of the gross domestic product (GDP) of the USA, during the Second World War to 10 percent, which today would correspond to 2 trillion US dollars. During the global financial crisis, international aid amounted to around 5 percent of US GDP.

Trebesch: "The global rescue sums in the Corona crisis could break records and exceed the intergovernmental financial aid during the euro crisis. The emergency aid provided by the IMF and the World Bank is already skyrocketing, and the currency exchange transactions of the US Federal Reserve FED to provide dollar liquidity, so-called swap lines, are already at a level of 400 billion US dollars. But it is still unclear how many loans will actually flow in the end. We probably won't be able to match the enormous international transfers during the world wars, because these would today be equivalent to 2000 billion dollars per year.

According to the analysis, states borrow very large sums of money from each other, especially in times of crisis, and the sums often exceed the amounts transferred in international private markets. Especially aid in times of war and global financial crises is enormous. "Neither the planned EU aid package of 750 billion euros to tackle the Corona crisis nor the Greek loans are unusual in historical comparison," said Trebesch.

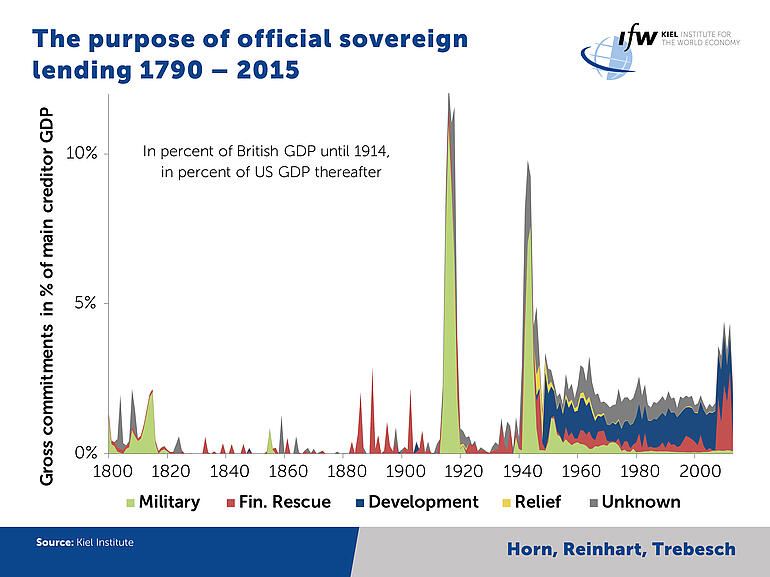

Since the second half of the 20th century, capital flows between states have systematically increased. The main reason for this is the institutionalization of inter-governmental lending transactions by the IMF, the World Bank and also many regional development banks and rescue facilities, such as the European Stability Fund. China has also become a very large state lender. According to an analysis by the Kiel Institute, the rest of the world owed China more than 5 trillion US dollars in 2017. While loans for military and war financing declined in importance, official lending is increasingly granted for aid programs in financial crises and to promote development.

Mr. Trebesch criticizes that lending between states is largely non-transparent. "Up to now there has been hardly any reliable data available, apparently governments often have limited interest in disclosing to whom they lend money and what is repaid, even though these loans are tax-financed," he says.