Employment protection has to be harmonized within the Eurozone

Recession has put many Eurozone labor markets under stress, particularly those in Mediterranean countries that have inflexible markets. As part of ongoing reforms, many have tackled the labor market—under the explicit encouragement of the EU and the ECB.

Recession has put many Eurozone labor markets under stress, particularly those in Mediterranean countries that have inflexible markets. As part of ongoing reforms, many have tackled the labor market—under the explicit encouragement of the EU and the ECB.

Of course, labor-market reforms and macroeconomic policy matter in their own right, but an emerging consensus on the resolution of the Eurozone crisis has firmly linked the two in the minds of policymakers and economists, as well as market forces (Wyplosz 2013). While the importance of labor reforms has been well documented, the interaction with macroeconomics has not. The empirical and theoretical literature shows that firing costs reduce hiring and firing (see, e.g., OECD 2004). The interaction of firing costs and macroeconomic policies, by contrast, has received little attention so far from empirical economists. There are good reasons for thinking the two are linked.

In our recent work, we argue that larger firing costs lead to a more severe policy trade-off for central banks—i.e. more price stability is associated with more inefficient employment fluctuations (Faia, Lechthaler and Merkl 2013). This is particularly worrisome in a monetary union with heterogeneous firing costs, such as the Eurozone, and calls for a harmonization of firing costs across countries to make sure that the ECB can perform an efficient policy for all member states.

Since Bentolila and Bertola (1990), we have known that firing costs reduce both hiring and firing. Since these effects work in opposite directions on aggregate unemployment, the overall effect on unemployment is ambiguous. This ambiguous relationship is confirmed by theory (e.g. Pissarides 2000) and cross-country studies.

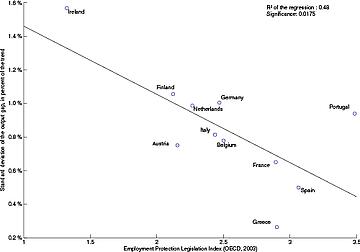

By contrast, the interaction of firing costs and the business cycle has been neglected until recently. Two recent studies (Abbritti and Weber 2010, and Merkl and Schmitz 2011) have empirically shown that larger firing costs reduce output fluctuations (see Figure 1 for an illustration for the Eurozone). Given that firing costs matter for the business cycle, firing costs may be of relevance for monetary policy, too.

Figure 1 – Output volatility and employment protection index (1/1999-2/2008)

Since the existing literature has neglected the optimal design of monetary policy in this context, we make a first step in this direction. We use a selection model based on Lechthaler et al (2010), who provide a simple and intuitive framework to analyze the consequences of labor turnover costs for business cycle fluctuations. The model is based on the idea that employers do not randomly hire workers that they are matched with, but rather assess the suitability of job applicants and select only those workers who are most productive. A similar logic applies to the decision of whether to keep a worker or to fire her. When the losses generated by the worker are higher than the cost of firing, the worker will lose her job.

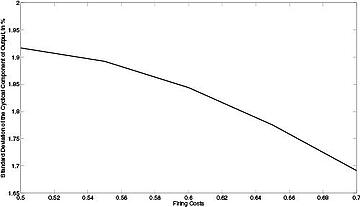

Naturally, the magnitude of firing costs plays an important role for both decisions. Higher firing costs do not only increase the costs of separations and thus reduce the firing rate. They also put restrictions on the behavior of firms and reduce their profitability. This tends to decrease the hiring rate: firms become more selective when choosing their workers because they know that it is expensive to separate from them. Thus, the model can very well explain the empirical relationship between firing costs and hiring/firing rates discussed above. It can also replicate the stylized fact that the economies of countries with higher firing costs tend to be less volatile over the business cycle (see Figure 2).

Figure 2 – Output volatility and firing costs in the model simulation

What is important for macroeconomic policy is the fact that this relationship implies important externalities, i.e., the market left alone will not work efficiently. By hiring a worker today, firms reduce the future pool of applicants. This implies that firms hiring tomorrow will on average have to employ workers with lower productivity. We show that this negative composition effect cannot be offset by standard wage-setting mechanisms (neither collective nor individual). Thus, optimal monetary policy should be designed to reduce the macroeconomic effects of this externality.

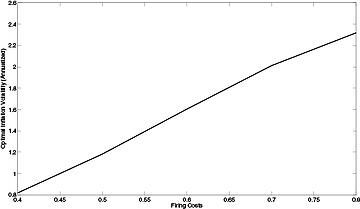

Moreover, the extent of the described externality depends crucially on the size of firing costs. The higher firing costs are, the more damaging the externality becomes. A central bank facing higher firing costs should, thus, allow for larger deviations from its long-run inflation target to reduce this externality (see Figure 3). Thus, the mandate of the ECB to solely maintain price stability is associated with welfare costs. To be more precise, a pure price-stability policy (i.e. stabilizing inflation at its target) is suboptimal.

Figure 3 –Firing costs and optimal inflation volatility

This implies severe complications for the Eurozone. With its large differences in firing costs (see Figure 1), the monetary policy for the average Eurozone is not appropriate for every single country. Thus, there is a need for the harmonization of firing costs. The divergence in the monetary transmission mechanisms due to the differences in labor-market institutions impairs the efficacy of the ECB’s policy. Without harmonization, firing costs increase the tensions that are already present within the Eurozone.

References

- Abbritti, Mirko and Sebastian Weber (2010). “Labor Market Institutions and the Business Cycle: Unemployment Rigidities vs. Real Wage Rigidities”. ECB Discussion Paper 1183.

- Bentolila, Samuel and Giuseppe Bertola (1990). “Firing Costs and Labor Demand: How Bad Is Eurosclerosis?”. Review of Economic Studies 57(3): 381–402.

- Faia, Ester, Wolfgang Lechthaler and Christian Merkl (2013). “Labor Selection, Turnover Costs and Optimal Monetary Policy”. Journal of Money, Credit and Banking, forthcoming.

- Lechthaler, Wolfgang, Christian Merkl and Dennis Snower (2010). “Monetary Persistence and the Labor Market: A New Perspective”, Journal of Economic Dynamics and Control, 34(5), 968-983.

- Merkl, Christian and Tom Schmitz (2011), “Macroeconomic Volatilities and the Labor Market: First Results from the euro Experiment”. European Journal of Political Economy 27(1): 44–60.

- OECD (2004). OECD Employment Outlook. OECD, Paris.

- Pissarides, Christopher (2000). Equilibrium Unemployment. Cambridge, MIT Press.

(slightly revised version of an article first published on VOVEU on February, 9, 2013 under the title “Monetary Policy and Firing Costs”)