News

Kiel Trade Indicator 06/22: Unusually long congestion in the North Sea, improvements in North America

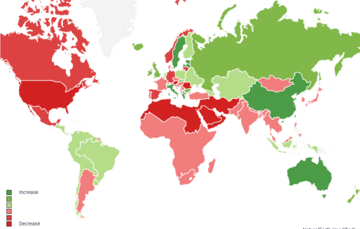

According to the latest data update of the Kiel Trade Indicator, world trade is up 0.4 percent in June compared with the previous month (price and seasonally adjusted). For Germany, the figures indicate an increase in imports (+2.5 percent) and a red zero for exports (-0.1 percent). In the EU, there are only moderate changes in both exports (-0.5 percent) and imports (+0.8 percent).

Indication for trade in June in the USA is somewhat clearer, with both exports (+3.2 percent) and imports (+1.1 percent) showing a plus. The signs for China's trade are also positive for exports (+1.7 percent) and imports (+4.0 percent). For Russia, the Kiel Trade Indicator inJune predicts exports just above zero (+0.3 percent) and a renewed decline in imports (-5.8 percent).

“Overall, world trade shows a slightly positive trend in June, but significant congestion, high transportation costs and resulting supply chain woes dampen the exchange of goods,” says Vincent Stamer, head of Kiel Trade Indicator.

“In contrast, the situation in North America improves. The pandemic induced high demand growth for consumer goods has slowed and the congestion off the port of Los Angeles has dissolved. This eases transportation shortages and as a result freight rates from Asia to the North American West Coast have already fallen by almost half since the beginning of the year. Transportation costs on route from Asia to Northern Europe on the contrary remain six times as high as compared to two years ago.“

Congestion of container ships in the North Sea continues and is on the rise. Over 2 percent of global cargo capacity is at a standstill there and cannot be loaded or unloaded. The queue is also growing off Shanghai and Zhejiang, with over 4 percent of global cargo capacity stuck here.

“An end to congestion in container shipping is currently not in sight. While long queues have also been observed off Shanghai in the past, for example, this is very unusual for the North Sea. For Germany and the EU, this primarily affects overseas trade, especially with Asia, from where, for example, consumer electronics, furniture, or textiles are delivered,“ says Stamer.

On the Red Sea, the most important trade route between Europe and Asia, there are currently more than 20 percent fewer container ships on the move than would be expected under normal circumstances. The last time the gap was this large was after the outbreak of the COVID-19 pandemic two years ago. “A decisive factor could be that the negative effects of the Shanghai lockdown are now becoming apparent due to the 40-day voyage from China to Europe. The container ship congestion in the North Sea and an increasing importance of rail transport due to the New Belt and Road Initiative may also be reducing freight volumes in the Red Sea,“ Stamer says.

Freight volumes in Russia's ports now point quite clearly to an attempt to substitute European trade with Asian ones. In the Baltic Sea port of St. Petersburg, where goods arrive from Europe, freight volumes have suffered a sustained slump. The other two largest container ports are more involved with Asian trade and are recovering somewhat. “However, imports from Asia have not yet been able to replace trade with Europe,“ says Stamer.

The next Kiel Trade Indicator updates will be on July 20 (without media information) and August 5 (with media information for July 2022 trade data).

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into real, seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.