News

China business could become a problem for German companies

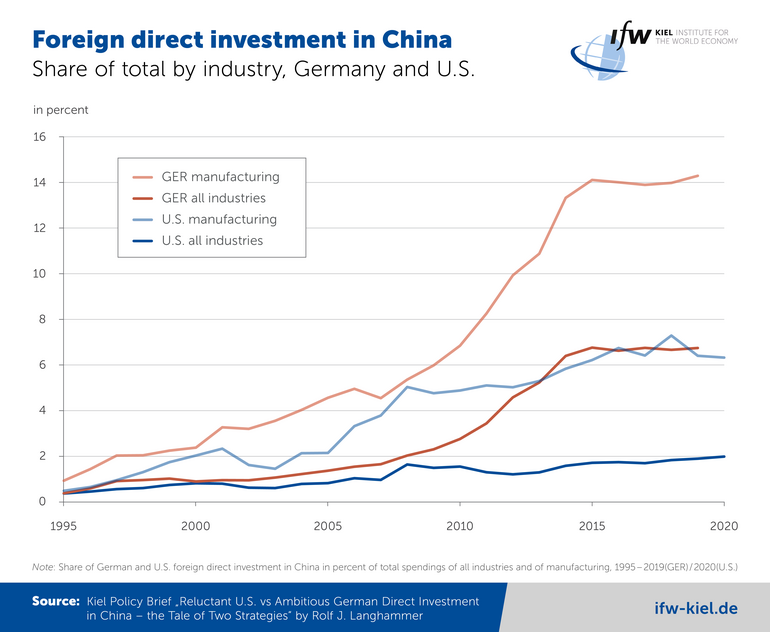

Since the 1990s, the number of subsidiaries and production facilities of German companies in China has been rising continuously. An analysis by Rolf J. Langhammer, a trade researcher at the Kiel Institute for the World Economy, shows that around 7 percent of Germany's total foreign direct investment was recently made in China, equivalent to around 89 billion euros (data basis 2019). In 2000, the figure was only around 1 percent. (R. J. Langhammer: Reluctant US vs Ambitious German Direct Investment in China – the Tale of Two Strategies).

In the manufacturing industry, i.e. in the chemical, mechanical engineering, and automotive sectors, foreign direct investment in China rose from a good 2 percent in 2000 to as much as 14 percent recently (61 billion euros). The automotive industry alone invested 24 percent of its foreign assets in China (26 billion euros).

By contrast, the USA, the world's largest foreign investor, has so far avoided this growth region, focusing instead on investments in Europe. In 2020, only around 2 percent of all foreign direct investment flowed to China (110 billion euros). For manufacturing companies, the figure was a good 6 percent (54 billion euros). In 2000, the share of US foreign investment in China was on a par with that of Germany, totaling around 1 percent and 2 percent in the manufacturing sector, respectively.

”The reluctance of US companies is all the more astonishing because China has been one of the most dynamically growing regions of the world for many years, offering companies an extremely lucrative sales market. Moreover, in recent years China has also been gradually granting foreign firms access to the services sector, where US firms are world leaders. Quite obviously, the concerns about being exploited by China for knowledge transfer or spying on sensitive and security-relevant information are too big,” says Langhammer.

The US implements investment controls to protect national security not only against foreign companies seeking to establish operations in the US. It also regulates the expansion of US companies outside the US to ensure that sensitive information cannot fall into foreign hands as a result. Germany, on the other hand, only regulates the activities of foreign companies at home through its Foreign Trade Act, not the investments of domestic companies abroad, such as in China. China is pushing foreign companies to supply its own market less through trade and more through foreign subsidiaries.

”China's goal is to become less dependent on foreign countries, especially its systemic rival, the United States, and to be able to produce key technologies itself. To achieve this, the country needs know-how that it does not yet have. Foreign investors must realize that they are supposed to serve this goal and will be replaced by domestic suppliers as soon as the latter have the necessary technological expertise,” says Langhammer. ”German companies, especially in the automotive industry, have made profits in China for many years, and now their dependence on the Chinese market may become a problem. They have provided Chinese companies with the necessary know-how to be replaced by them in the future, thus helping China to gain a more powerful negotiating position in the geopolitical competition.”